In today’s fast-paced world, many individuals find themselves entrapped in the cycle of living paycheck to paycheck, where financial stability feels like a distant dream. Breaking free from this pattern requires strategic planning and disciplined execution. In this comprehensive guide, we will uncover strategies that explore cutting unnecessary expenses, boosting your savings, and fostering a mindset geared towards financial independence. Whether you are striving to build an emergency fund or optimize your monthly budget, understanding these essential steps can empower you to take control of your financial future and achieve lasting prosperity.

Understand the Root Cause of Your Financial Gaps

Identifying the root cause of your financial gaps is crucial in breaking the cycle of living paycheck to paycheck. Often, these gaps are not merely about earning too little, but rather about how finances are managed and allocated.

Start by conducting a thorough financial assessment. Review your bank statements, employment income, and monthly expenses diligently. Ensure you categorize your spending to distinguish between essential and non-essential expenditures. This clear differentiation will allow you to pinpoint areas where you may be unknowingly overspending.

Once you have a clear picture of your spending habits, it becomes easier to identify patterns that might be contributing to your financial stress. For many, this might be tied to habits formed over time or unforeseen expenses that disrupt savings plans.

Ultimately, recognizing and understanding these gaps provides a foundation for more informed financial decisions. This step is essential in creating a strategy that not only addresses immediate financial shortcomings but also builds towards long-term financial security and stability.

Start an Emergency Fund Immediately

In today’s volatile economic climate, establishing an emergency fund is crucial for achieving financial stability and breaking free from the cycle of living paycheck to paycheck. An emergency fund acts as a financial safety net, providing you with the security needed to handle unexpected expenses such as car repairs, medical emergencies, or sudden unemployment.

Begin by setting a realistic savings goal. Aim to accumulate three to six months’ worth of living expenses. This amount should sufficiently cover your essential costs such as housing, food, and utilities in case of unforeseen circumstances.

Automating your savings is a practical step towards building your emergency fund. By setting up automatic transfers to a dedicated saving account, you ensure consistent contributions without the temptation to spend elsewhere. Even a modest amount saved regularly can grow substantially over time.

To start, review your current expenses and identify possible areas to reduce spending. Redirect these funds to your emergency fund. Discipline and commitment to your financial goals are key factors in overcoming financial challenges.

Remember, the importance of an emergency fund cannot be overstated. It not only provides financial coverage for unexpected events but also offers peace of mind, allowing you to focus on achieving a more secure and prosperous financial future.

Budget Based on Priorities Not Habits

Creating a budget based on your priorities rather than your habits is a critical step toward achieving financial stability. When you focus on what’s truly important, you are more likely to allocate your resources wisely and reduce unnecessary spending.

Begin by clearly defining your financial goals. This could include saving for emergencies, paying off debt, or investing in your future. By understanding what matters most to you, you can reallocate funds from less important habitual expenses to these vital goals.

Track and analyze your current spending patterns to identify areas that need adjustment. This involves examining where your money is currently going and how those expenditures align with your priorities. You might find that certain habits, such as daily coffee runs or subscription services, can be cut back or eliminated altogether.

Implementing a priority-based budget allows you to make informed financial decisions. It encourages restraint where needed, fostering a disciplined approach that not only helps in stopping the cycle of living paycheck to paycheck but also builds a stronger financial foundation.

Automate Savings Every Payday

One of the most effective ways to break the cycle of living paycheck to paycheck is by automating your savings. This method ensures that a portion of your income is set aside before you ever have a chance to spend it on non-essential items.

To start, set up an automatic transfer from your checking account to a savings account each payday. Determine a fixed percentage or amount that you’re comfortable saving. This strategy not only builds your savings over time but also helps create a habit of consistently prioritizing your financial future.

By automating your savings, you remove the temptation to spend the money impulsively and secure your personal finances in the long run. It’s a simple, yet powerful, tool to build a financial safety net, allowing you to achieve financial stability and peace of mind.

Cut Expenses That Don’t Add Value

In the pursuit of achieving financial stability, it’s imperative to scrutinize your spending habits and eliminate expenses that do not bring meaningful value to your life. Begin by examining recurring costs such as subscriptions, memberships, and other automatic deductions from your account. Assess whether these services truly enhance your lifestyle or if they were impulsive decisions that can be cut back.

Another strategy is to minimize spending on non-essential items that fail to provide long-term satisfaction. This includes frequent dining out, excessive shopping, and unnecessary luxuries. Consider creating a budget that distinguishes between needs and wants, allowing you to prioritize spending on what truly matters.

Furthermore, evaluate utility bills and find ways to optimize usage—turning off unused electronics, implementing energy-saving practices, and seeking better deals with providers. Small adjustments can lead to substantial savings over time.

Ultimately, by making conscious decisions to cut expenses that don’t add value, you pave the way towards financial freedom and move away from the restrictive cycle of living paycheck to paycheck.

Increase Your Income with Extra Skills

Many individuals find themselves caught in the cycle of living paycheck to paycheck. A viable solution to escape this cycle is to increase your income by acquiring additional skills. Investing time in learning new abilities not only enhances your professional growth but also opens up new avenues for earning potential.

Begin by identifying skills that complement your current job or explore areas you are passionate about. In an ever-evolving job market, skills such as digital marketing, coding, and graphic design are in high demand. Enrolling in online courses or attending workshops can swiftly enhance your proficiency in these areas.

Additionally, leveraging your newfound competencies in a freelance capacity can significantly boost your income. Many platforms provide opportunities for skilled professionals to offer their services on a project basis, allowing you to work flexibly and earn extra money on your terms.

Engage with professional networks and communities for continuous skill enhancement and exposure. This not only increases your capability but also your visibility to potential clients and employers. By continually upgrading your skill set, you position yourself adeptly to handle more challenges and seize more lucrative opportunities.

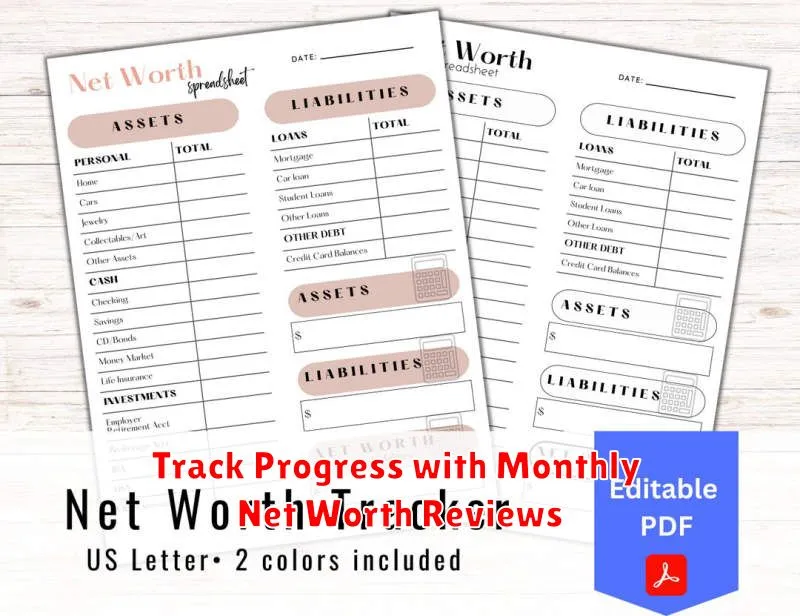

Track Progress with Monthly Net Worth Reviews

One effective method to avoid living paycheck to paycheck is to conduct monthly net worth reviews. By doing this, you are taking a proactive stance in managing your financial health. Tracking your net worth involves listing all your assets—such as cash, investments, and property—against your liabilities, including loans and debts.

Setting aside time each month to review your net worth can provide you with a clear picture of where you stand financially. This allows you to recognize patterns, understand your spending habits, and identify areas where you can save or invest better. It’s an important step to establish control over your finances and make informed decisions that can positively impact your financial status long-term.

A consistent review process helps you monitor your progress towards financial goals, such as saving for retirement or paying off debts. Utilize spreadsheets or personal finance apps to make this task more efficient. Over time, these reviews will build a habit of financial discipline, which is crucial to breaking the cycle of living paycheck to paycheck.

Use a Zero-Based Budgeting System

The Zero-Based Budgeting System is a strategic approach to managing your finances, ensuring every dollar you earn is allocated to specific expenses, savings, or debt repayment. This methodology can significantly aid in breaking the cycle of living paycheck to paycheck by promoting deliberate and accountable spending.

Unlike traditional budgeting methods, where you might simply track what you spend, the zero-based approach requires a plan for every dollar at the start of each month. The primary goal is to assign a purpose to every dollar, resulting in a budget that “zeros out.” This meticulous planning helps in minimizing wasteful expenditures and maximizing financial efficiency.

When implemented correctly, a zero-based budget allows you to prioritize financial goals, such as building an emergency fund, paying off debt, or investing in retirement savings. By actively deciding where your money should go, rather than wondering where it all went, you become more proactive and secure in managing your financial resources.

Furthermore, this system encourages transparency and accountability, as you assess your spending habits and adjust accordingly. Over time, this shifts your financial mindset from reactive to proactive, making it easier to save, spend wisely, and break free from the cycle of living paycheck to paycheck.