Creating and sticking to a budget can often feel like an insurmountable challenge, yet mastering it is a key step toward achieving financial freedom. When we hear the word “budget,” it’s easy to associate it with constraints or limitations on our spending habits. However, learning how to stick to a budget without feeling restricted can transform this perception, turning budgeting into a powerful tool to gain control over your finances and even leading you to greater financial confidence. In this guide, we’ll explore smart techniques and strategies that help maintain your lifestyle while ensuring your spending is in harmony with your financial goals. Embark on this journey with us, and soon, you’ll discover that budgeting is not about deprivation, but about priorities and making informed choices.

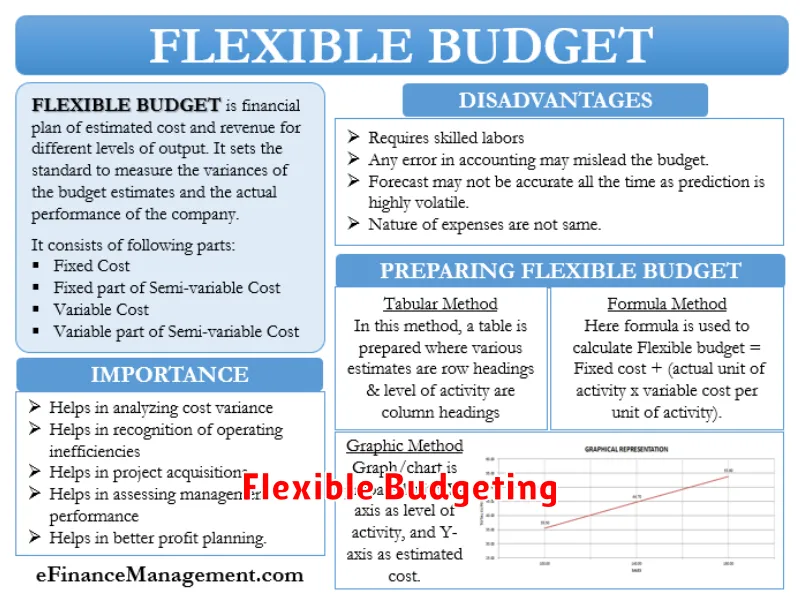

Set Flexible Spending Categories

When creating a budget, it’s crucial to establish flexible spending categories that allow you some latitude without compromising your financial goals. These categories cater to unforeseen expenses or provide a cushion for discretionary spending, ensuring you don’t feel excessively restricted.

Begin by identifying areas where spending can fluctuate, such as dining out, entertainment, or shopping. Allocate a specific amount for each category, ensuring it aligns with your overall financial plan. By setting these limits, you maintain control while allowing yourself the freedom to enjoy life’s pleasures without compromising your financial stability.

To ensure your budget remains adaptable, regularly review these categories and adjust as necessary. This practice helps in keeping spending in check while also responding to changes in your lifestyle or priorities.

Setting flexible spending categories is an effective strategy to uphold a balanced budget, allowing you to fulfill necessary constraints while living a comfortable and fulfilling life.

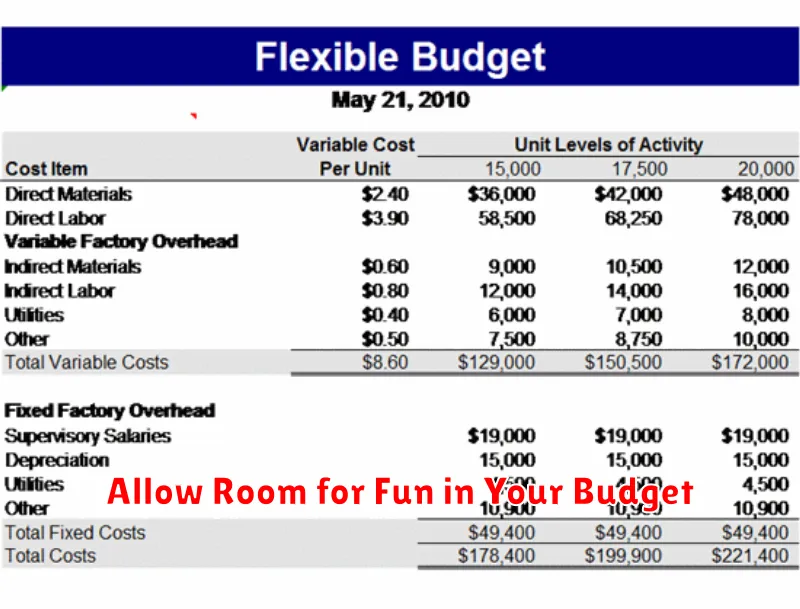

Allow Room for Fun in Your Budget

When creating a budget, it is crucial to allocate funds not only to necessities but also to areas that bring joy and fulfillment. By doing so, you can maintain a balance between financial responsibility and personal satisfaction. Incorporating entertainment and leisure into your budget can help prevent feelings of restriction and improve well-being.

Start by setting aside a specific amount for fun activities each month. This can include dining out, movies, or any hobbies that bring you happiness. By planning for these expenses, you can enjoy them guilt-free and avoid impulsive spending that might otherwise derail your financial goals.

Flexibility is key. Every month may bring different opportunities for enjoyment. Adjust your budget accordingly to accommodate new interests or events. This adaptability ensures that your budget remains a tool that supports your lifestyle rather than a constraint.

Finally, remember that fun does not always mean spending money. Explore cost-effective options such as community events, outdoor activities, or simply enjoying quality time with friends and family. By being mindful yet open to enjoyment, you can stick to a budget without sacrificing happiness.

Use a Budgeting App That Suits Your Style

Adopting a budgeting app that matches your unique financial habits can significantly enhance your budgeting success. Such apps offer personalized features tailored to different preferences, ensuring that the budgeting process is both efficient and effective.

There are numerous options available, ranging from simple dashboards for those who prefer a straightforward approach, to more complex systems that provide detailed analytics for in-depth planning. Recognizing your budgeting style is crucial in choosing an app that complements rather than constrains your lifestyle.

Using an app that aligns with your needs can transform the sometimes-tedious task of budgeting into a more engaging and manageable activity. Features like real-time notifications, customizable spending categories, and goal-setting tools can make budgeting feel less like a chore and more like a part of your daily routine.

Choose an app that encourages you to remain engaged with your financial health without overwhelming you. This not only fosters a sense of financial freedom but also supports your long-term financial goals with minimal effort.

Automate Savings First Before Spending

Allocating funds for savings before addressing your spending priorities is a strategic way to ensure financial stability. By setting up automatic transfers, you can ensure that a designated portion of your income is directed towards savings or investment accounts each month.

This approach allows your savings to grow consistently without the temptation to spend it elsewhere. It also instills a disciplined financial habit that prioritizes your future goals.

Some financial institutions offer features to automate these transfers, making the process seamless and efficient. Consider this an essential step to maintain a budget that feels freeing rather than restrictive.

This method not only provides peace of mind but also establishes a proactive approach to financial planning, making it easier to adhere to your budgetary confines without feeling like you’re missing out on life’s pleasures.

Review Your Budget Weekly, Not Just Monthly

When it comes to maintaining a financial plan, many people make the common mistake of reviewing their budget only at the end of each month. While this is an essential practice, a more proactive approach could significantly enhance your financial habits.

By incorporating a weekly review of your budget, you gain better control and immediate insight into your spending patterns. This allows you to make timely adjustments before small discrepancies become substantial issues. It’s about being flexible enough to adapt and stay on track with your financial goals.

A weekly check-in provides the opportunity to celebrate minor successes and address problems promptly, helping to prevent a build-up of financial stress. It also fosters a stronger connection with your finances, reducing the feeling of being restricted by enabling a more dynamic response to your financial circumstances.

Practice Conscious Spending Daily

Adopting a mindset of conscious spending can play a pivotal role in maintaining a budget without experiencing the sensation of being restricted. By making informed choices about where and how you spend your money, you align your expenditures with what truly matters to you. This daily practice ensures that every dollar spent provides optimal value and satisfaction.

Start by reflecting on your financial priorities and distinguishing between needs and wants. This helps in ensuring your spending aligns with your long-term goals and values. Allocating funds to areas that enrich your life and cutting back on impulsive purchases or frequent, unnecessary expenses can lead to a more balanced financial life.

Be mindful of habitual purchases that may seem insignificant individually but add up over time. By tracking these expenses, you can identify patterns that can be adjusted to better serve your budget. Making small but meaningful changes in daily habits can prevent feeling deprived and instead empower you through intentional spending.

Ultimately, the goal of practicing conscious spending daily is not about rigid restrictions but about making thoughtful decisions. This approach allows you to enjoy life’s pleasures within your means, fostering a sense of financial freedom and contentment.

Reframe Budgeting as Freedom, Not Restriction

Many individuals perceive budgeting as a set of financial shackles that limit their enjoyment and lifestyle. However, by shifting this perspective, budgeting can be viewed as a path to financial freedom. The notion here is not about what you’re eliminating but what you’re enabling yourself to achieve.

Budgeting empowers you to allocate resources towards what truly matters, be it saving for a new home, investing in education, or ensuring a secure retirement. Instead of focusing on the limitations, emphasize the goals you’re setting and the opportunities those goals will afford you in the future. This mindset transforms constraint into empowerment.

Consider budgeting as a strategy for prioritizing expenditures, making deliberate choices that align with your values. By consciously deciding where each dollar goes, you cultivate a sense of control over your finances, thus reducing stress and uncertainty.

Ultimately, the power of budgeting lies in its potential to grant you freedom to make decisions that reflect your priorities, rather than letting financial circumstances dictate your decisions. This proactive approach turns a perceived restriction into a pathway towards your desired future.

Adjust Categories Based on Life Changes

As life evolves, so too should our financial plans. The concept of budgeting is not meant to be static; it should adapt to accommodate new priorities and circumstances. Whether you’re getting a new job, moving cities, or starting a family, these changes can impact your financial situation significantly. Recognizing and adjusting your budget categories during such transitions is crucial to maintaining a balanced financial life without feeling overly restricted.

Start by examining which areas of your budget need changes. For example, a new job might increase your commute expenses but reduce other costs, such as in-office meals. Evaluate your current spending patterns and pinpoint any areas where adjustments can be made to accommodate these changes. This provides a more accurate picture of your overall financial health and helps maintain or grow your savings.

Consider reallocating funds to categories that necessitate more attention. For instance, if you’re welcoming a new family member, it might be wise to increase your allocation towards groceries and healthcare. This proactive approach ensures you don’t feel deprived in essential areas while also keeping you aligned with your financial goals.

Do not hesitate to revisit your budget frequently as changes can occur more often than anticipated. Regularly updating your budget categories allows for smoother transitions and minimizes stress, ensuring that your financial plan remains a true reflection of where you are in life.