In today’s fast-paced world, maintaining healthy financial habits can be challenging, making the introduction of effective tools paramount for personal finance management. Financial journaling has emerged as a powerful practice, offering individuals the opportunity to closely monitor their spending, savings, and investment behaviors. By incorporating this habit, you can gain valuable insights into your financial patterns and identify areas for improvement. Whether you’re looking to cut unnecessary expenses, increase your savings, or optimize your investments, understanding the importance of financial journaling can lead to long-term economic well-being. This article delves into the nuances of why integrating financial journaling into your routine can significantly enhance your money management skills and ultimately improve your overall financial health.

What Is Financial Journaling and How It Works

Financial journaling is a practice where individuals document their financial transactions, thoughts, and goals to gain a better understanding of their spending habits, savings, and overall financial health. By maintaining a financial journal, one creates a personal record that highlights patterns, reveals areas of improvement, and aids in making informed monetary decisions.

To start financial journaling, you need a dedicated notebook or a digital tool where you can regularly log expenses, income, and any financial observations. The journal acts as a mirror reflecting your financial behaviors, offering insight into where money is being spent and highlighting potential areas for budgeting.

The process of financial journaling involves setting clear financial objectives, tracking day-to-day expenditures, and periodically reviewing your entries. Regular reviews of the journal entries help in identifying trends and progress towards achieving personal finance goals, thus serving as a practical tool for personal growth in financial literacy.

Overall, financial journaling is an invaluable process that not only aids in keeping track of financial movements but also encourages individuals to develop stronger money management skills, ultimately leading to more consistent and disciplined economic behaviors.

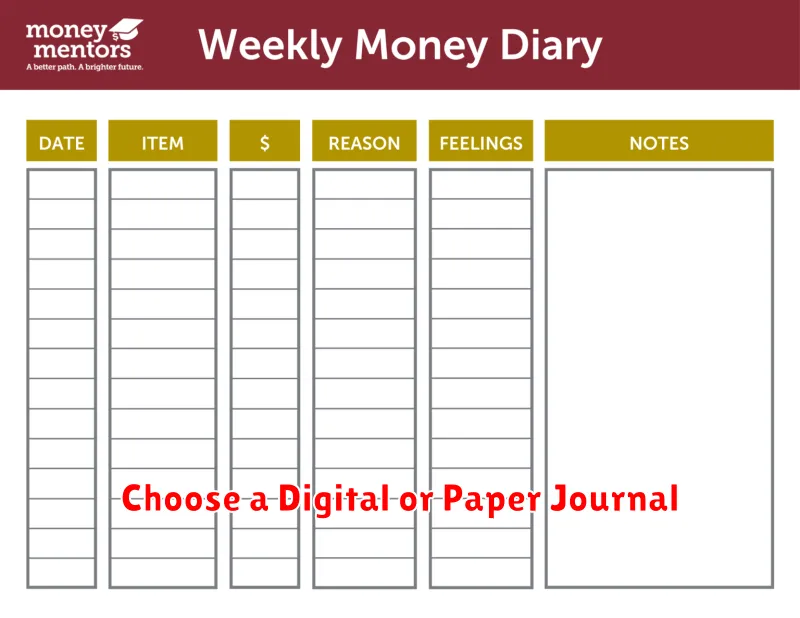

Choose a Digital or Paper Journal

An essential step in starting your financial journaling journey is deciding between a digital or paper journal. Each option has distinct advantages tailored to different preferences and lifestyles.

Digital journals offer enhanced accessibility, allowing you to update your entries on-the-go through smartphones or computers. They also provide organizational tools such as tags and search functions, making it easy to track your financial progress.

On the other hand, a paper journal can provide a more intimate and reflective experience. The act of writing by hand can aid in better memory retention and emotional engagement, which might be beneficial when reflecting on financial habits and goals.

Ultimately, the choice between digital and paper depends on your personal style and how you interact best with information. Choose the format that encourages consistency and fosters a deeper understanding of your financial habits.

Log Daily Spending and Emotional Triggers

One key element of financial journaling is to log daily spending. This involves diligently recording every purchase, no matter how small, allowing you to gain a clear and comprehensive overview of your current financial habits. By maintaining this daily record, you can identify where your money goes and recognize any patterns or excessive spending areas.

Alongside tracking your expenses, it is equally important to note emotional triggers associated with each transaction. Understanding the emotional context can unveil compelling insights into your spending behavior. Do certain emotions like stress or happiness lead to specific purchases? Identifying these triggers empowers you to take control over impulse buying and align your spending with your financial goals.

Documenting both spending and emotions in your financial journal promotes self-awareness and accountability. It helps you recognize and reflect on the deeper reasons behind your financial decisions, paving the way for more informed and deliberate choices in the future. Thus, establishing a habit of logging and analyzing this information plays a transformative role in enhancing your overall money management skills.

Reflect Weekly on Financial Wins and Setbacks

Establishing a regular practice to reflect on your weekly financial activities can significantly enhance your awareness and control over your money habits. This weekly reflection involves reviewing both your financial wins and setbacks to identify patterns and opportunities for improvement.

By acknowledging financial wins, you reinforce positive behaviors that contribute to your financial well-being. These can include sticking to a budget, successfully saving a portion of your income, or finding a great deal on necessary purchases. Such reflections help you appreciate the impact of your diligent efforts.

Conversely, analyzing financial setbacks provides valuable insights into areas that need attention. Whether it’s an unexpected expense or overspending in a particular category, understanding these challenges allows you to develop strategies to prevent similar issues in the future.

Consistent weekly reflections foster a mindset of learning and adaptation, crucial components for long-term financial improvement. Over time, this practice can transform the way you perceive and manage your finances, paving the path to financial success.

Write Monthly Money Goals and Progress

Establishing monthly money goals serves as a pragmatic approach to financial management. This practice involves setting explicit financial objectives for each month, allowing you to focus on short-term tasks that can have a significant impact on your overall financial health.

Documenting your financial goals at the start of each month aids in maintaining accountability and offers a structured plan to achieve desired outcomes. By doing so, you can track your progress, identify potential challenges, and adapt your strategies to remain on course.

It’s crucial to ensure that these goals are both realistic and measurable. Ensure that objectives like saving a specific amount, reducing debt by a certain percentage, or boosting your income through a side hustle are explicit and attainable within the set timeframe.

Regularly reviewing your progress not only reinforces positive money habits but also provides valuable insights into where adjustments might be necessary. This ongoing assessment allows for swift corrective measures and bolsters your confidence in managing finances effectively.

Use Templates for Better Organization

When it comes to financial journaling, maintaining a well-structured approach is essential. By leveraging pre-designed templates, you can significantly enhance your organizational skills. These templates serve as a guideline, helping you categorize and track financial entries with ease.

Templates provide a consistent format that ensures all necessary elements are included in your financial records. This consistency not only saves time but also reduces the likelihood of overlooking critical information. With a comprehensive template, you can easily input data and access it whenever needed, making your financial analysis more efficient.

Moreover, templates can be customized to fit your specific needs. Whether you are tracking expenses, income, or investments, a well-crafted template facilitates better data management. This tailored approach allows you to focus on areas that require more attention while offering a clear picture of your overall financial status.

Incorporating templates into your financial journaling routine ultimately fosters better financial habits by promoting consistency and clarity in tracking and managing money-related activities.

Build Financial Awareness Over Time

The act of maintaining a financial journal offers a clear pathway to cultivating financial awareness over time. By routinely documenting income, expenses, and savings, individuals like yourself can gain a more comprehensive understanding of their financial behavior.

This practice allows you to identify patterns and triggers that may impact your financial decisions. Over time, you can pinpoint areas where adjustments are necessary, leading to more informed and strategic monetary choices.

Habits formed through consistent journaling can significantly enhance your ability to manage finances effectively, empowering you to set realistic financial goals and track progress diligently. As your awareness builds, so does your capability to make decisions that align with your long-term financial health.

In summary, financial journaling is not just a record-keeping exercise, but a critical tool for developing a profound understanding of personal finance management, potentially transforming your financial resilience over time.