In a world where financial stability is crucial, creating an effective debt repayment strategy is paramount. The Debt Snowball Plan has emerged as a popular method to help individuals tackle their financial obligations with greater efficiency and speed. This strategy focuses on paying off smaller debts first, allowing you to gain momentum and confidence as you work your way up to larger balances. By following this approach, you can reduce stress and financial burden while moving closer to the ultimate goal of becoming debt-free. In this guide, we’ll delve into the specifics of how to create and implement a Debt Snowball Plan that will empower you to pay off your debts faster and achieve financial freedom.

What Is the Debt Snowball Method?

The Debt Snowball Method is a strategic financial approach designed to help individuals pay off their debts by focusing on one debt at a time. This method emphasizes paying off the smallest debt first, while maintaining minimum payments on all other debts. By doing so, individuals can gain a quick sense of accomplishment, which helps build momentum.

After the smallest debt is eliminated, the funds that were previously allocated to that payment are then directed toward the next smallest debt. This process continues, creating a “snowball” effect, where the amount available to pay off debts grows as each debt is settled. As the remaining debts decrease, the payoff speed increases, giving individuals a clearer path to becoming debt-free.

The Debt Snowball Method is particularly effective for those who benefit from seeing quick results and need motivation to tackle larger financial challenges. It prioritizes psychological rewards and behavioral changes, fostering a more positive mindset towards financial management.

List Debts from Smallest to Largest

When creating a Debt Snowball Plan, one of the key initial steps is to list your debts from the smallest to the largest. This method focuses on building momentum by paying off debts quicker and celebrating small victories along the way.

Start by gathering all your debt information, including the outstanding balance for each. Then, arrange them in order from the smallest balance to the largest. This list should exclude interest rates or monthly payment amounts, focusing solely on the size of the debt itself.

Sorting your debts in this manner provides a clear roadmap for your payoff process. Begin by targeting the smallest debt first. By eliminating the smallest debts quickly, you free up money to direct towards the next debt on the list, thus creating a snowball effect as you progress through your debts.

This strategic approach not only provides a structured plan to pay off debt faster but also increases motivation as each cleared debt brings a sense of accomplishment. This method has helped many people effectively manage and reduce their financial burdens.

Make Minimum Payments on All Except the Smallest

In the debt snowball method, it’s crucial to focus on paying off debts strategically to gain momentum. The first step involves making minimum payments on all your debts, except for the smallest debt. This strategy helps you maintain your financial responsibilities while channeling more resources toward eliminating the smallest balance.

By ensuring that other debts are staying current, you prevent any negative impact on your credit score through missed payments. Meanwhile, concentrating any extra funds on the smallest debt allows you to pay it off faster and achieve a sense of accomplishment, reinforcing your commitment to becoming debt-free.

This approach not only provides a clear path forward but also empowers you psychologically. Successfully eliminating a debt, even a small one, can provide a motivational boost that propels you forward. As each small debt is paid off, you gain more money to tackle the next smallest debt, quickening the pace of the entire process.

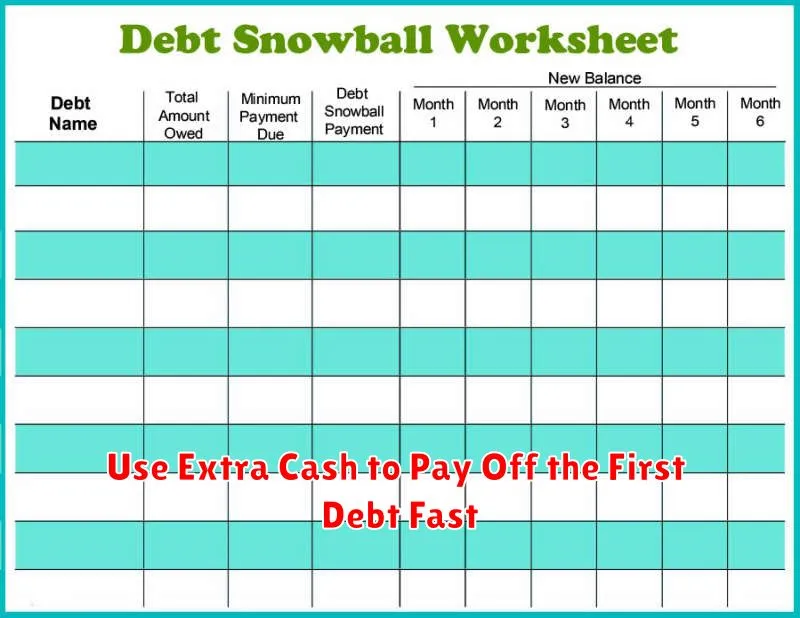

Use Extra Cash to Pay Off the First Debt Fast

When employing the debt snowball method to eliminate your debts, channeling any extra cash towards your initial debt can accelerate the payoff process. By applying surplus money to the first debt on your list, you can swiftly reduce its balance, making it easier to eradicate.

Identify additional funds by evaluating your monthly budget or contemplating temporary income sources such as part-time jobs, selling unneeded items, or cutting non-essential expenses. Dedicate these resources specifically to your first debt.

Accelerating the repayment of this first, smaller debt not only diminishes your total debt but also boosts your morale and momentum. As this debt is settled, direct the funds previously used for its payment to the next debt, reinforcing the snowball strategy.

Consistently applying extra cash ensures a swifter path to achieving financial freedom and reinforces the habit of managing monies effectively, setting a robust foundation for financial stability.

Stay Motivated by Celebrating Small Wins

When you’re implementing a debt snowball plan to pay off your obligations more efficiently, maintaining motivation can be challenging. One effective strategy is to celebrate small wins along the way.

Each time you eliminate a smaller debt, take a moment to acknowledge this achievement. This not only provides a sense of progress but also reinforces your commitment to achieving financial freedom. Celebrating these victories doesn’t have to be extravagant. It could be as simple as enjoying a treat or spending a relaxing day off.

By recognizing these incremental successes, you maintain a positive mindset, which fuels your determination to tackle larger debts. Consistently celebrating small wins helps sustain your momentum and keeps you focused on your ultimate goal—becoming debt-free.

Track Your Progress with Visual Tools

Keeping a close eye on your debt repayment journey is crucial for staying motivated and on track. Utilizing visual tools can provide a clear picture of where you stand and how far you’ve come in your debt snowball plan.

One popular method is creating a debt thermometer, which visually represents your debt and your gradual climb towards paying it off. This can be a chart that you can hang in your home, updating it regularly as you reduce your debt amount.

Another effective tool is a spreadsheet that tracks each debt’s balance over time. You can input your payments each month, and watch as the totals decrease, offering a satisfying view of your progression.

There are also many apps and online platforms designed to help track your financial journey. They often come with interactive charts and graphs, making it easy to visualize your progress. Choose tools that best suit your preferences to maintain your motivation and focus throughout the debt repayment process.

What to Do After Paying Off All Debts

Once you have successfully conquered your debts, it’s important to utilize your newfound financial freedom wisely. Begin by reflecting on your financial goals and creating a comprehensive plan for the future.

First, consider building a robust emergency fund if you haven’t already. An emergency fund acts as a safety net, protecting you from unexpected expenses and providing peace of mind.

Next, look into investment opportunities. These could include retirement accounts such as a 401(k) or IRA, which will help ensure your financial security in the long term.

Moreover, reassessing your budget is crucial. With no debt payments, you now have more flexibility. Allocate portions of your income towards savings, investments, and essential expenses efficiently.

It’s also beneficial to regularly review your financial status. Keep track of your expenses, savings growth, and investment performance to stay on top of your finances.

Finally, consider treating yourself in moderation to celebrate your achievement. However, ensure that any splurges do not disrupt your financial stability.