In an era where consumerism and the relentless pursuit of wealth often take center stage, the concept of living below your means stands out as a prudent financial strategy that promises not just economic well-being but also long-term stability. This approach entails spending less than what one earns, thereby fostering a sense of financial independence and future security. By consciously choosing to curtail unnecessary expenses and focusing on essential needs, individuals can significantly boost their savings, invest in future growth opportunities, and smoothly navigate economic uncertainties. Living below your means isn’t merely about restraint; it’s about empowering oneself with the knowledge and resources to achieve a more meaningful and financially resilient life.

What It Really Means to Live Below Your Means

Living below your means is a financial philosophy that entails spending less than you earn. It requires individuals to exercise self-discipline and prioritize needs over wants, thus ensuring that their financial obligations are met without compromising future financial security.

This practice involves making conscious decisions to limit expenditures, opting for a lifestyle that allows for savings and investment. It is not about denying oneself comfort or enjoyment, but about making thoughtful choices that align with long-term financial goals.

Understanding and embracing this approach can lead to greater financial stability, reduced stress, and enhanced life satisfaction. By living below your means, you are better equipped to handle emergencies, pursue opportunities, and ultimately achieve financial independence.

Differentiate Between Income and Lifestyle

The distinction between income and lifestyle is fundamental in achieving financial stability. While income is the amount of money earned through various sources such as salary, investments, or business, lifestyle refers to how one chooses to live, spending to maintain their standard of living.

Many individuals fall into the trap of allowing their lifestyle to inflate alongside rising income, a phenomenon often termed as lifestyle creep. This can prevent individuals from achieving long-term financial goals, as more resources are channeled towards maintaining appearances or temporary luxuries.

To truly benefit from living below your means, it is crucial to separate income from lifestyle. Ensure that increases in income are not automatically matched by increased spending on non-essential items. This conscious practice strengthens financial discipline by emphasizing savings and investments over extravagant consumption.

Understanding and applying the difference between income and lifestyle ensures a protective buffer against unforeseen financial setbacks, and paves the way for sustainable financial freedom.

How to Resist Peer Pressure and Overspending

In a world where consumerism is abundant, resisting peer pressure is a significant step to avoid overspending and achieve financial stability. One effective approach is to set clear financial goals and stick to them. By outlining what truly matters to you, such as saving for a home or retirement, you can more easily dismiss external pressures to conform to spending habits that do not align with your objectives.

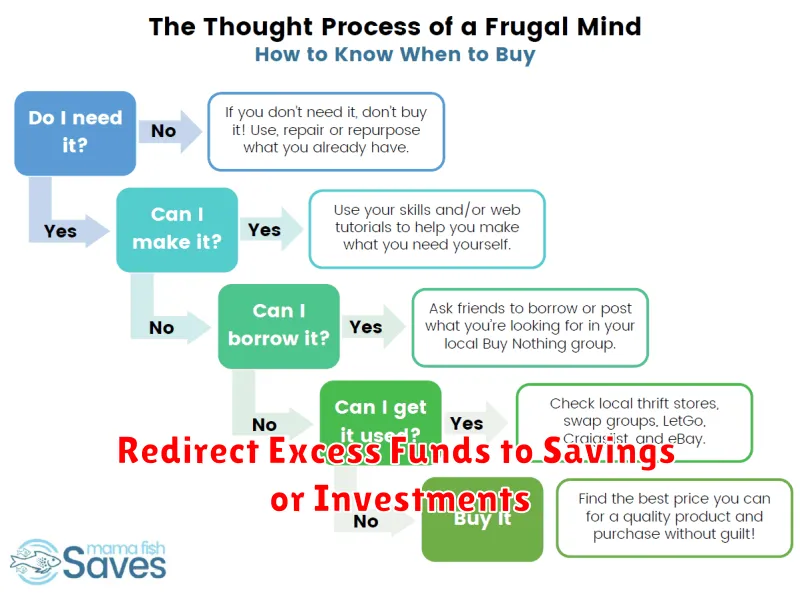

Another method to combat peer pressure is practicing mindful spending. Before making any purchase, ask yourself if it’s a need or a want, and whether it aligns with your long-term financial goals. This conscious approach ensures you are spending money on what truly matters to you, rather than succumbing to the expectations of others.

Additionally, cultivate a supportive environment by surrounding yourself with individuals who respect your financial values. Friends who understand and share your financial goals can offer encouragement and help you stay accountable in your journey to living below your means.

Lastly, developing a strong sense of self-worth that is independent of material possessions can help resist the urge to prove your worth through spending. Focus on activities and relationships that enhance your quality of life without necessarily having a high financial cost. By adopting these strategies, you can effectively counteract peer pressure and overspending, ultimately supporting your financial well-being.

Redirect Excess Funds to Savings or Investments

Living below your means can significantly increase your financial stability. One of the primary benefits of this lifestyle is the opportunity to redirect excess funds to savings or investments. This strategic allocation of money not only enhances your financial security but also aids in building wealth over time.

By directing surplus money towards savings accounts, individuals create a buffer for unexpected expenses and emergencies, ensuring peace of mind. Furthermore, placing additional funds into investment vehicles such as stocks, bonds, or mutual funds can generate returns that compound over the years, significantly increasing your net worth.

It is essential to assess one’s financial goals and risk tolerance before choosing the appropriate investment avenues. Consistently redirecting funds towards these financial instruments helps in achieving long-term financial goals, such as retirement or purchasing a home, much earlier than anticipated. Ultimately, living below your means empowers you to strategically manage finances in a way that ensures a secure and prosperous future.

Use Budget Surplus for Emergency Fund Growth

Living below your means frequently results in a budget surplus, which can serve as a pivotal financial buffer. Instead of directing these extra funds towards discretionary spending, consider channeling them into an emergency fund. This strategic move not only fortifies your financial security but also provides peace of mind in times of unforeseen expenses.

An emergency fund acts as a financial safety net, enabling you to navigate unexpected events such as medical emergencies or sudden job loss without disrupting your financial stability. By prioritizing the growth of this fund, you ensure that minor financial hiccups do not escalate into significant burdens.

Allocating your budget surplus to an emergency fund is a testament to responsible financial planning. It exemplifies a proactive approach to personal finance, reinforcing your ability to maintain a stable financial course regardless of external circumstances.

Create Long-Term Security Through Modest Living

Adopting a strategy of modest living is an effective way to ensure long-term financial security. By consciously choosing to live below your means, you not only decrease current expenditures but also foster a strong habit of savings and financial discipline.

One of the foremost benefits of modest living is the reduction of financial stress. With lower monthly expenses, you create a financial buffer that can protect against unforeseen events such as job loss or medical emergencies. This buffer serves as a safety net, enabling you to endure financial setbacks without resorting to debt.

Furthermore, modest living promotes the ability to save consistently. The money saved from cutting unnecessary expenses can be directed into investments or retirement accounts, which over time, results in significant wealth accumulation. By prioritizing savings over consumption, individuals ensure a more secure financial future.

In addition, modest living cultivates an appreciation for non-material pleasures, leading to a healthier approach to consumption. This lifestyle shift can enhance overall satisfaction and contentment by minimizing the impact of consumerism on personal happiness.

Implementing modest living requires commitment and informed decision-making. By embracing this lifestyle, you create a stable financial foundation, ensuring long-term security and peace of mind. It is a sustainable approach that not only protects financial wellbeing but enhances quality of life.

How Living Frugally Enhances Mental Peace

Embracing a frugal lifestyle not only benefits financial well-being but also significantly enhances one’s mental peace. In today’s fast-paced world, the constant pressure to keep up with societal expectations of consumption can often lead to stress and anxiety. By choosing to live below your means, individuals can free themselves from these tensions and create a more serene life.

Living frugally encourages a mindset of contentment, reducing the urge to compare oneself to others. This perspective not only nurtures gratitude for what one already possesses but also diminishes the desire for unnecessary acquisitions, which often lead to financial burdens and mental distress.

Moreover, reduced financial obligations and a simplified lifestyle contribute to lower stress levels. Without the constant worry of meeting ends or handling overwhelming debt, individuals can experience a profound sense of relief and mental clarity, allowing them to focus on what truly matters.

Furthermore, saving money through frugality enables individuals to build an emergency fund, offering a safety net in unpredictable situations. The reassurance of having financial security in the face of emergencies contributes to an enhanced sense of peace and reduced anxiety about the future.