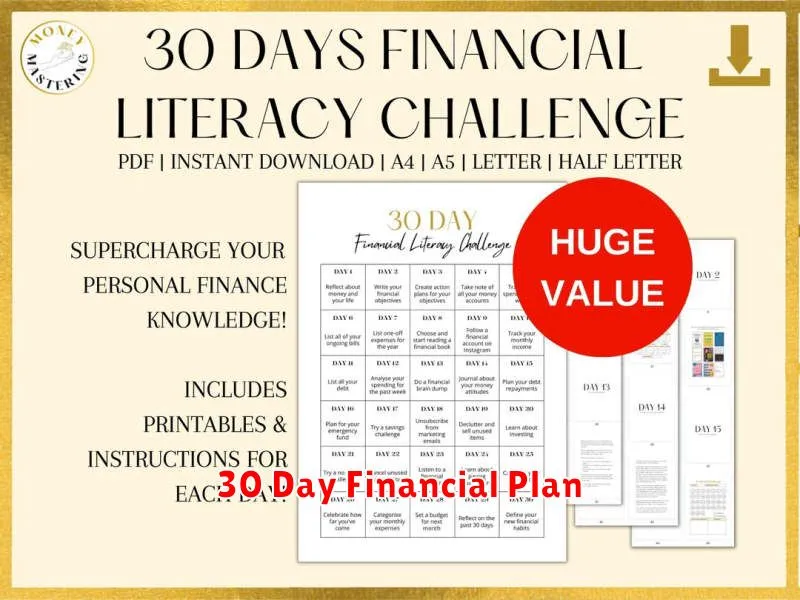

Taking control of your finances can feel like a daunting task, but with the right approach, you can significantly enhance your financial health in just 30 days. Whether you are just starting or seeking to refine your financial strategies, following structured steps over the course of a month can lead to meaningful improvements. In this comprehensive guide, we will delve into proven techniques and valuable insights that empower you to build a robust financial foundation, ensuring a more secure and stable future. By focusing on key areas such as budgeting, saving, and investing, you’ll be equipped to make informed financial decisions and achieve your monetary goals. Embrace the journey towards financial empowerment and discover how to transform your economic outlook with these essential steps.

Start with a Full Financial Self-Assessment

Embarking on the journey to better financial health begins with understanding where you stand financially. This step is crucial as it helps you identify your strengths and weaknesses, allowing you to make informed decisions.

Start by evaluating your current income sources. Document all the money you earn from employment, side gigs, and other income streams. This gives you a clear idea of your total cash inflow.

Next, analyze your expenses. Categorize them into essentials like rent, utilities, and groceries, and discretionary spending such as dining and entertainment. Knowing your spending patterns helps you spot areas where you can cut costs.

Assess your debt obligations. Make a list of all your debts, including credit cards, student loans, and mortgages. Understand the interest rates and minimum payments to prioritize debt repayment strategies.

Review your assets and liabilities. Take stock of your possessions, investments, and savings accounts. This will give you a snapshot of your net worth, highlighting areas for potential improvement or investment.

Finally, set realistic financial goals. Goals provide motivation and direction for managing your money. Make sure they are achievable within your 30-day plan and contribute to long-term financial stability.

Create a Realistic 30-Day Financial Goal

Embarking on a journey to improve your financial health requires setting a realistic 30-day financial goal. This serves as a short-term target meant to inspire regular financial discipline and enhance your monetary management skills.

Begin by thoroughly assessing your current financial situation. Document your income streams, monthly expenses, and any outstanding debts. Highlight areas with potential for cost reduction without compromising essential needs.

Once your financial landscape is clear, establish a specific, measurable, and achievable goal. For instance, aim to save an additional 10% of your monthly income or reduce unnecessary expenses by a set amount. Ensure your goal fits within the confines of a single month to maintain focus and accountability.

Track your progress with daily or weekly check-ins and adjust your strategies as needed. Utilize tools such as budgeting apps or spreadsheets to maintain accuracy and transparency.

Completing this goal within 30 days empowers you to make significant strides in your financial well-being, ultimately laying the groundwork for more substantial financial ambitions in the future.

Declutter Your Financial Accounts

One crucial step in improving your financial health is to declutter your financial accounts. This process involves reviewing and organizing your current financial accounts to ensure efficiency and clarity.

Start by listing all your accounts, such as bank accounts, credit cards, investment accounts, and any other financial assets you own. This provides a comprehensive view of your financial landscape, helping to identify unnecessary or duplicate accounts.

Analyze each account to determine its relevance and utility. Close accounts with high fees or those you no longer use to minimize financial complexity and reduce exposure to potential fraud.

Consider consolidating accounts where possible to streamline management and enhance tracking of your financial activities. Consolidation helps prevent oversight and makes it easier to maintain a budget.

Finally, ensure all your accounts are secure. Update passwords and activate alerts for any suspicious activities. These steps will maintain your financial health and security, contributing to a stronger financial future.

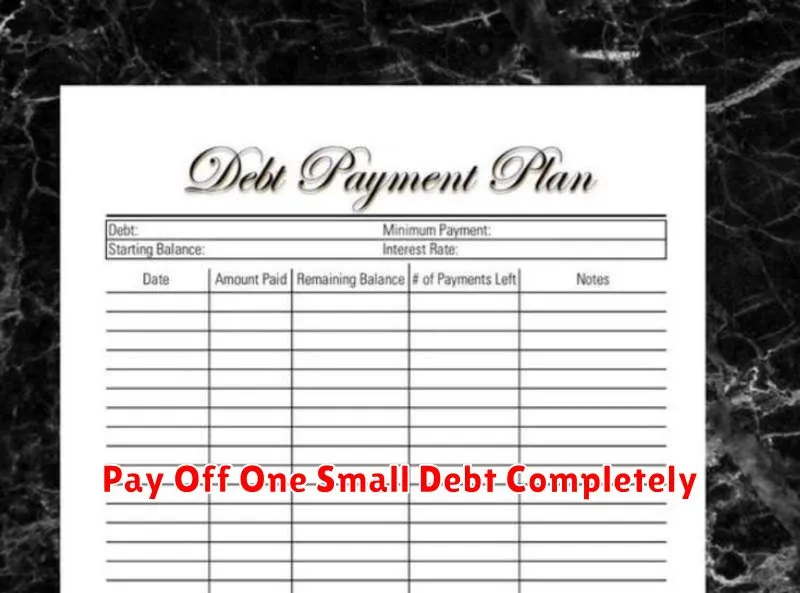

Pay Off One Small Debt Completely

Achieving better financial health often begins with small, manageable steps. In a 30-day plan to improve finances, completely paying off one small debt can be a significant move that sets a positive tone for future financial management.

Start by identifying your smallest debt. This could be a credit card balance with a modest amount or a personal loan with a low remaining balance. The idea is to choose a debt that you can realistically pay off quickly without straining your financial resources.

Once identified, focus your efforts and resources on this debt while continuing to meet the minimum payments on other obligations. Allocate extra funds towards this debt each month, whether it comes from cutting unnecessary expenses, using a side income, or reallocating savings specifically for this purpose.

Successfully eliminating this debt provides immediate satisfaction and relief, freeing up additional funds that can then be redirected towards larger debts or other financial goals. Additionally, the experience of paying off one debt completely can boost your confidence, encouraging consistent and disciplined financial habits moving forward.

Remember, the journey to improved financial health is cumulative. Paying off one small debt is more than just a line crossed off your list; it’s a step toward building a stronger financial future.

Cut 3 Unnecessary Expenses Immediately

Improving your financial health begins with identifying where your money is unnecessarily draining away. By addressing these expenses, you can free up funds to allocate towards savings or more urgent needs.

1. Subscription Services: In today’s digital age, many of us are signed up for various subscription services, from streaming platforms to monthly product boxes. It’s essential to review these subscriptions regularly and decide which ones you truly utilize. Cancel those you rarely use to cut unnecessary costs.

2. Dining Out: While dining out can be a pleasant break, doing it too often can significantly impact your budget. Instead, opt to cook at home more frequently. This not only saves money but can also promote healthier eating habits.

3. Impulse Purchases: Impulse buying is a major financial pitfall for many. Before making a purchase, consider whether it’s a need or a want. Implementing a waiting period before buying non-essential items can help curb unnecessary spending.

Addressing these three areas can make a substantial difference in improving your financial health quickly and effectively.

Commit to No-Spend Weekends

One effective strategy to enhance your financial health is to commit to no-spend weekends. By consciously choosing not to spend money during the weekend, you can significantly increase your savings over time. This approach helps in identifying unnecessary expenditures and encourages a more mindful approach to spending.

To begin, plan activities that don’t require spending. Opt for free local events, enjoy nature trails, or host a potluck with friends. These activities not only ensure you stick to your financial goals but also provide enjoyable experiences without the monetary cost.

It’s important to also plan your meals in advance, using ingredients you already have. This cuts down on the urge to dine out and helps in utilizing your existing resources efficiently.

Overall, implementing no-spend weekends encourages fiscal responsibility and promotes a financially healthier lifestyle. Embracing this simple but powerful practice can have a long-lasting positive impact on your financial habits.

Set Up a Budget and Track Daily

To enhance your financial health in just 30 days, one of the most effective steps is to set up a budget and track it daily. A well-structured budget not only helps you manage your expenses but also ensures that you save and spend wisely.

Begin by evaluating your income sources. List all your monthly sources of income to get a clear picture of your financial inflow. It is crucial to know exactly how much money you have to work with each month.

Next, categorize your expenses. Break down your spending into categories such as housing, utilities, groceries, transportation, and entertainment. This will help you identify where your money goes and highlight areas where you can cut unnecessary spending.

Once your budget is set, make a commitment to track your spending daily. Utilize budgeting apps or spreadsheets to log every expense, no matter how small. This practice will give you a real-time understanding of your spending habits and help you stay within limits.

Regularly review your budget to adjust for any changes in income or expenses. Flexibility is key to maintaining an effective budget over time. By consistently monitoring your financial activities, you can make informed decisions and keep your financial health on track.

Celebrate Your Progress at the End of 30 Days

As you reach the culmination of your 30-day financial transformation journey, take a moment to recognize and celebrate your progress. This is not just a celebration of reaching the end, but an acknowledgment of the effort and commitment you displayed throughout the process.

Initially, you set specific financial goals to achieve, and now you have a clearer understanding of your financial health. Whether it’s reducing unnecessary expenses, increasing savings, or establishing a realistic budget, celebrate each of these achievements.

Reflect on the challenges you’ve overcome, and allow yourself to feel proud of the habits you have formed or improved. These improvements are a testament to your dedication and willingness to build a stronger financial future.

Maintaining motivation for financial health is integral to long-term success. Celebrate in ways that align with your commitment to financial wellness, such as enjoying a modest treat or planning for future goals with your newfound skills.

Acknowledge this milestone as the beginning of a continuous journey towards better financial stability. Let this celebration be a cornerstone in your ongoing pursuit of financial growth and security.