Managing your monthly expenses effectively is crucial in achieving financial stability and peace of mind. In today’s fast-paced world, where prices seem to be constantly rising, it’s vital to identify and implement simple ways to cut down on your monthly costs quickly. By making a few strategic adjustments and embracing mindful spending habits, you can witness a significant impact on your finances without drastically changing your lifestyle. In this guide, we will explore some effective strategies to reduce your monthly expenses fast, allowing you to save more and stress less about your budget.

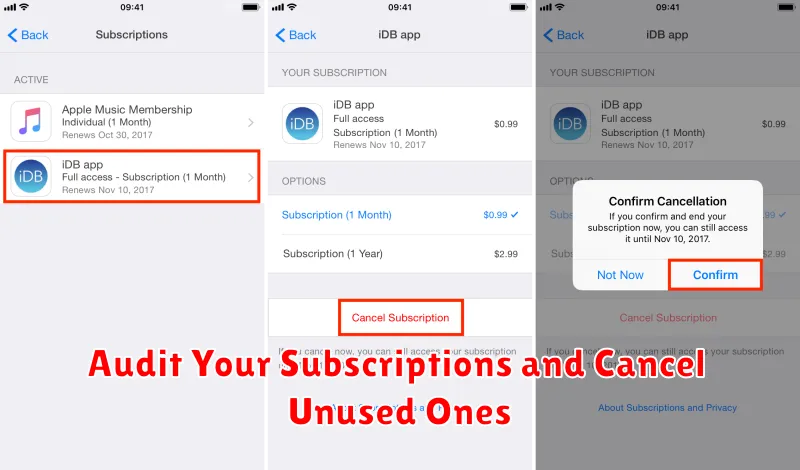

Audit Your Subscriptions and Cancel Unused Ones

Many individuals are becoming increasingly aware of how recurring subscriptions can affect their financial well-being. It is crucial to review your monthly subscriptions regularly. By conducting an audit, you can identify which subscriptions you no longer need or use.

Begin by making a list of all your current subscriptions, including streaming services, software, and memberships. Assess which ones still provide value and eliminate those that are unused or unnecessary. This simple step can significantly reduce your monthly expenses.

Consider how much you spend annually on these services and the potential savings from canceling unused subscriptions. By taking the time to audit your subscriptions, you enhance your ability to manage your budget effectively and reduce financial strain.

Switch to a More Affordable Phone Plan

An effective way to reduce your monthly expenses quickly is by switching to a more affordable phone plan. As mobile phone providers are constantly competing, there are numerous options available that offer excellent services at a reduced cost.

Start by evaluating how much data you actually use each month. Many people pay for more data than they need. Opting for a plan that closely matches your usage can lower your bill significantly.

Consider exploring prepaid plans which often offer lower rates without long-term contracts. Switching to a family plan can also offer substantial savings benefits, provided you have multiple lines in your household.

Don’t forget to take advantage of promotions and discounts. New customers or existing customers renewing contracts often qualify for special deals. Periodically compare plans to ensure you’re getting the best value for your money.

Cook at Home Instead of Ordering Food

One of the simplest ways to reduce your monthly expenses quickly is to cook at home rather than ordering food. Preparing meals in your own kitchen can be more cost-effective and offers the opportunity to create healthier dishes tailored to your preferences.

By choosing to cook at home, you not only save money but also gain control over ingredients, ensuring that your meals are both nutritious and enjoyable. This approach can significantly decrease your dining out budget, allowing you to allocate funds to other essential areas.

Additionally, home-cooked meals often mean leftovers that can be consumed the following day, making them an economical choice for stretching your food budget. Embracing home cooking as a habit not only promotes fiscal prudence but can also lead to a healthier and more balanced diet in the long run.

Use Public Transportation When Possible

One of the most effective methods to reduce monthly expenses is to embrace public transportation. By choosing buses, trains, or subways over personal vehicles, you can significantly cut down on fuel and maintenance costs. Additionally, public transportation often provides predictable schedules and can help reduce stress associated with driving.

Using public transport not only benefits your wallet but also contributes positively to the environment. Fewer cars on the road mean reduced emissions, which is a crucial step toward sustainable living. Many cities offer discounted monthly passes for frequent users, making it even more economical and accessible.

Moreover, by not having to focus on driving, you can utilize travel time productively, perhaps catching up on work or relaxation. Therefore, whenever possible, opt for public transportation to not only save money but also support environmentally friendly practices and ease urban congestion.

Buy Generic Instead of Name Brands

One of the most straightforward strategies to reduce your monthly expenses effectively is to choose generic products over name brands. In many cases, generic products offer the same quality and performance as their name-brand counterparts but at a fraction of the cost. This means you can enjoy significant savings without compromising on quality.

Supermarkets and drugstores frequently stock generic options, which typically have lower packaging and marketing costs. These savings are passed on to consumers, making it possible to keep your budget in check while still obtaining the products you need.

When shopping for everyday items such as groceries, household essentials, and over-the-counter medications, choosing generic brands can lead to noticeable savings over time. Always compare the ingredient lists and performance reviews, especially for items like medications, to ensure they meet your standards.

Embracing generics not only contributes to financial prudence but also encourages a shift towards more conscious spending habits. This strategy is an excellent way to cultivate a more economical lifestyle without sacrificing the quality and functionality of your purchases.

Bundle Insurance Policies for Discounts

One of the most effective and straightforward strategies to reduce your monthly expenses is to consider bundling your insurance policies. By combining multiple policies, such as home and auto insurance, under the same provider, you can often receive substantial discounts. This approach not only simplifies your bills but also can lead to significant savings over time.

Insurance companies encourage policyholders to bundle because it increases their business with existing clients. In return, they offer attractive discounts that can help lower your monthly expenditures. It’s advisable to compare offers from multiple insurance providers to ensure you receive the best deal for your specific needs. Don’t hesitate to ask your current provider about possible bundling opportunities to take advantage of these savings.

Remember, bundled policies may also offer the added benefit of unified billing, which can improve your financial management. This strategic approach to insurance can be a simple yet effective method to cut down on costs without sacrificing the coverage you need.

Cut Back on Utility Bills with Energy Hacks

Reducing utility bills can significantly lower your overall monthly expenses. By implementing simple energy hacks, you can create a more efficient home environment, saving both energy and money.

One effective way to cut costs is by using energy-efficient appliances. These appliances consume less electricity, reducing your usage and bills over time. Look for ENERGY STAR labels when shopping for products, as they ensure efficiency.

Another excellent strategy is to regularly maintain and service your HVAC systems. Clean filters and well-maintained systems maximize efficiency, translating to reduced energy consumption and lower costs.

Smart thermostats offer a modern solution by allowing you to control temperature settings remotely. This means you can minimize heating or cooling when not needed, thus reducing unnecessary energy usage.

Small changes, such as sealing leaks around doors and windows, can have a significant impact. By keeping the cold or warm air inside, your heating and cooling systems require less energy to maintain the desired temperature.

Finally, encourage efficient habits like turning off lights and unplugging devices when they’re not in use. These habits, while simple, contribute to decreased energy usage and help in cutting back on those utility bills.

Use Cashback and Discount Apps to Save More

One of the simplest and most effective ways to reduce your monthly expenses is by utilizing cashback and discount apps. These tools are designed to help you save money on purchases you would make anyway, by providing you with cash rewards and exclusive discounts.

By implementing these apps into your shopping routine, you can accumulate significant savings over time. Many of these platforms partner with a wide range of retailers, allowing you to earn cashback on everything from clothing and groceries to electronics and more.

Furthermore, these apps frequently update their offers, which encourages users to take advantage of new deals. This proactive approach to savings not only extends your budget but also promotes smarter spending habits.

In conclusion, integrating cashback and discount apps into your financial strategy is an effective way to reduce costs quickly. They provide a convenient and often overlooked method to maximize savings without significantly altering your purchasing habits.